Dear Reader:

EEDAR Q3 2018 report - Switch owners playing a ton, spending even more, and are eager for Smash Bros. Ultimate/Pokemon: Let's Go Pikachu/Eevee

EEDAR has come out with a massive round-up of info for the games industry in Q3 2018. They look at the games people are most excited to play, playtime across platforms, and the Fortnite phenomenon. Check out the full report below.

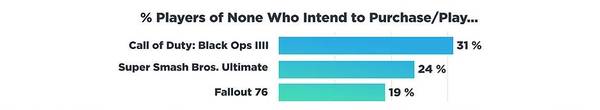

Call of Duty: Black Ops IIII has been at the top of our purchase intent list since the title was announced earlier this year. Early impressions and betas for Blackout have come out in the last month, and purchase intent has remained healthy for the title. Super Smash Bros. Ultimate is also prepped to be a big seller for Nintendo this holiday, though Nintendo’s Pokémon: Let’s Go is tracking outside of the top five. Kingdom Hearts III, which will finally be releasing in Q1 2019, is right behind Pokémon: Let’s Go (a good place to be). It’s worth noting that Kingdom Hearts III has been tracking well throughout its pre-release cycle. The momentum generated from the critical success of Resident Evil 7 seems to have carried over to the remake of Resident Evil 2, helping it to round out the top ten list this quarter.

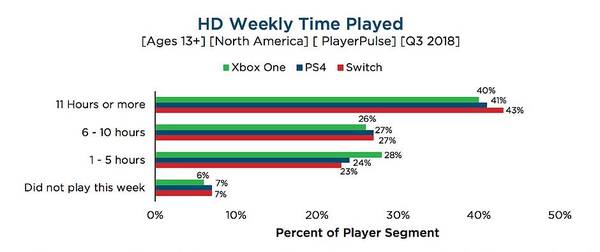

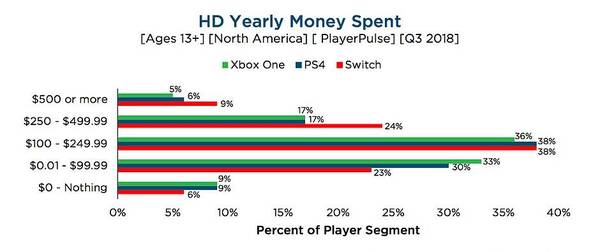

Investment between console platforms is largely similar. PlayStation owners are more likely to invest larger amounts of time/money than their Xbox counterparts, but not significantly so. This shouldn’t be too much of a surprise since, at this point, cross-ownership between the two platforms is high (PlayerPulse shows 27-28% of Xbox One/PS4 players own the other platform). Switch owners don’t stand out much when comparing time played (though they’re still playing with their new toy more often than anyone else), but they are significantly more likely to have spent large amounts of money on console gaming in the past year when compared to other platform owners. That shouldn’t be too much of a surprise, as it can largely be accounted for by hardware purchases. It is worthwhile to note that both measures of investment for the Switch were higher last year, when the console was brand new, showing that more casual gamers have begun adopting the console this year.

This Quarter's Notable Story: Fortnite

The biggest story going into the summer this year is Fortnite. Kids are playing it, and adults are confused by it, or at least that’s the word going around. With PlayerPulse, we can take a deeper look at demographics for both the HD and mobile versions of the game.

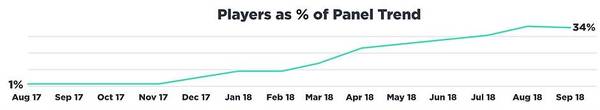

Despite releasing back in September of 2017, Fortnite’s growth has been slow but steady, with the popularity of the game increasing over time in tandem with improvements and milestones. Epic has nurtured a growing community via quick iteration, balancing, map changes, selling Battle Passes, and environmental mysteries/story telling. The rise of popular streamers like Ninja has fed the fever, keeping players invested and tuned in even when they’re not playing, and everyone involved has benefited for it (Ninja is even in commercials now).

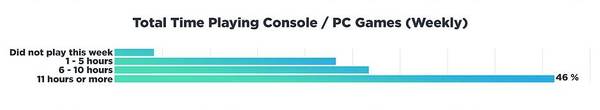

Fortnite players are heavily invested, with 30% of Console/PC Fortnite players spending 11 or more hours per week playing HD games. This puts them more in line with people who have played World of Warcraft or Grand Theft Auto V, rather than more casual titles such as The Sims 4 or Minecraft.

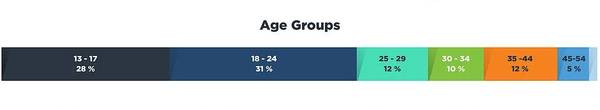

Fortnite also has one the youngest populations of any game tracked in PlayerPulse. Only Minecraft boasts a larger population of teenagers, but this drops off significantly when compared to Fortnite for players ages 18-24. This is true on HD platforms as well as mobile. It’s tempting to think that Fortnite’s bright art style and online-focused gameplay would share a population of players from younger experiences such as Minecraft, but looking at other demographic measures, that’s clearly not the case.

Males make up two-thirds of the player base, which is more typical of core HD games like Call of Duty and World of Warcraft, rather than casual titles like Minecraft, which have larger female populations. This makes sense as, despite its wide appeal, Fortnite is still a Shooter and shares similar demographics to other Shooter games. This is also true for Fortnite on mobile, where splits look similar to Strategy games like Clash of Clans and Clash Royale, as opposed to titles with wider appeal like Candy Crush or Pokémon GO.

Speaking of online gameplay, PlayerPulse also allows us to look into what other titles those Fortnite players are interested in purchasing. The standout for upcoming games players intend to purchase is Fallout 76, which comes in as the third most likely to be purchased by Fortnite players; significantly higher than in other segments. Fallout 76’s gameplay matches up to the always online, sometimes cooperative gameplay of Fortnite.

Overall, Fortnite is more of a complicated story than some may think. It can’t be summed up by comparison to any single game. It skews young like Minecraft, but monetizes and attracts males like Shooters on PC/Console, and Strategy games like Clash Royale and Clash of Clans on mobile. Fortnite players are competitive by nature, but are also interested in cooperative experiences like Fallout 76. Growth finally seems to have plateaued in September 2018, but only time will tell if this is a temporary pause for Fortnite’s growth, as their young audience has begun shifting back to school life after summer vacation, or the start/end of something else.